W-2 Employee List

Use this page to work with the records of company employees who are to receive W-2s.

The 5 search fields located directly below the workflow icons are displayed by default and may be used to filter the results that display.

| Field | Description |

|---|---|

| Tax Year | Tax year being reported. The current year is the default. You may select any of the previous 3 tax years, also. |

| EIN | Company tax ID. This entry may contain 9 characters. |

| Paperless |

Filters the list to show only those employees who receive W-2s electronically (Yes), only those who do not receive W-2s electronically (No) or both types of employees (Both). Both is the default selection. Employees who receive W-2s electronically have the Paperless W-2 check box selected in the Demographics section of the Workforce Administration Personal tab. |

| Last Name and First Name | Name of employee. Use these fields only if you are searching for a particular employee. |

| SSN | Employee's social security number. Use this field only if you are searching for a particular employee. |

After making your entries, click the Search button to initiate the search.

The search results display in a grid located below the search controls.

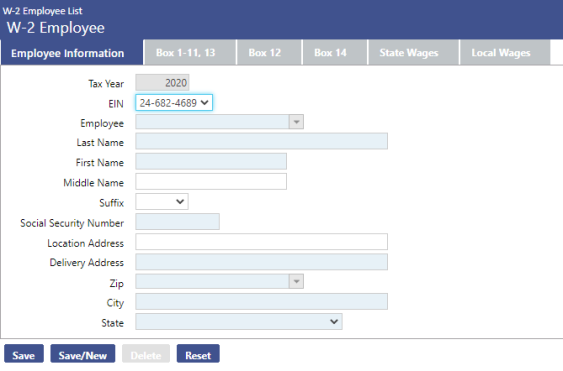

If you have an employee who should receive a W-2 but is not on the list, click the New button. The W-2 Employee page opens, with the Employee Information tab open as the default. ![]() Show me.

Show me.

| Field | Description |

|---|---|

| Tax Year | Tax year being reported. Populated based on the year selected on the W-2 Employee List page, this field is disabled. |

| EIN | Company tax ID. All of the EINs set up on the W-2 Company List page for the selected tax year are available for selection. |

| Employee |

If the person to be added is an employee, you may click in the Employee field to select him from a drop-down list or click the blue-eye icon Once you make the selection, the remaining fields populate with information from the existing employee record. If the person is not an employee, complete the remaining fields. |

| Last Name, First Name, Middle Name, Suffix | Employee's name and, if applicable, name suffix. The last and first name are required and may contain 50 characters each. The middle name may contain 20 characters. |

| Social Security Number | Required. Employee's social security number. |

| Location Address | Populated by line two of the employee's Mailing Address in Employee Maintenance. If line two is blank, this field is populated by line 2 of the Home Address. |

| Delivery Address | Populated by line one of the employee's Mailing Address in Employee Maintenance. If line one is blank, this field is populated by line 1 of the Home Address. |

| Zip |

Zip code of the employee's address. This field is populated by the Zip Code of the employee's Mailing Address in Employee Maintenance or, if blank, by the Zip Code of the Home Address. The entry may be in a standard zip format or a zip+4 format. If you use the zip+4 format, include the hyphen between the fifth and sixth digits (49660-1234). As you type the numbers, zip codes most closely matching your entry display on a drop-down. Select the correct one. When you <Tab> or click off the field, the City and State fields populate with the entries corresponding with the zip code. |

| City and State | City and state of the employee's address, populated by the City and State of the employee's Mailing Address in Employee Maintenance or, if blank, the City and State of the Home Address. You may edit either entry if it is different from the one the system selects. The City entry may contain 50 characters. |

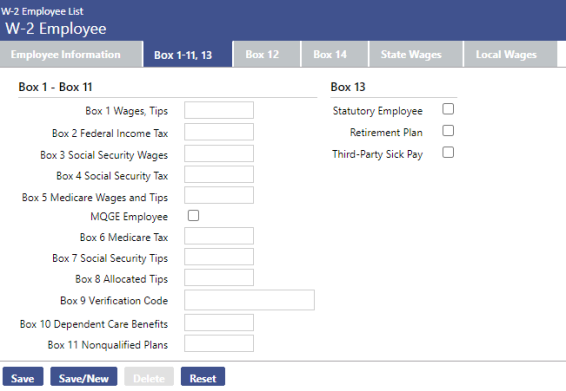

After filling in the employee information, click the Boxes 1-11, 13 tab. ![]() Show me.

Show me.

Fill in the information that should appear on the W-2 form.

| Field | Description |

|---|---|

| Boxes 1-11 | |

| Box 1 Wages, Tips | Federal taxable wage (before payroll deductions) paid to the employee during the year. |

| Box 2 Federal Income Tax | Federal income tax withheld from the employee's wages for the year. |

| Box 3 Social Security Wages |

Total wages paid (before payroll deductions) and subject to employee Social Security tax but not including Social Security tips and allocated tips. The sum of Box 3 Social Security Wages and Box 7 Social Security Tips may not exceed the taxable wage base amount published by the IRS for the tax year reported. |

| Box 4 Social Security Tax |

Employee Social Security tax withheld, including Social Security tax on tips. The amount may not exceed the tax rate published by the IRS for the tax year reported. |

| Box 5 Medicare Wages and Tips |

Total of wages and tips subject to Medicare tax. This value must be greater than or equal to the sum of Box 3 Social Security Wages and Box 7 Social Security Tips. |

| MQGE Employee |

Tells whether the employee is exempt from paying Medicare. The system issues a warning if this box is checked and the amount in Box 5 Medicare Wages and Tips is greater than zero. |

| Box 6 Medicare Tax |

Total employee Medicare tax withheld. The amount includes only tax withheld for wages and tips. |

| Box 7 Social Security Tips |

Total tip wages the employee reported. The sum of Box 3 Social Security Wages and Box 7 Social Security Tips may not exceed the taxable wage base amount published by the IRS for the tax year reported. |

| Box 8 Allocated Tips | Total tip wages allocated to the employee for this year. |

| Box 9 Verification Code |

Sixteen-character code verifying the authenticity of the W-2 data taxpayers submit on e-filed returns. As of 2017, the IRS has partnered with certain vendors to include this verification code on many employee W-2 forms; New World ERP, however, is not a selected vendor and does not fill in the Box 9 Verification Code field. The verification code does not display on the W-2 Register, but if the field is filled in, it displays on the W-2 form. |

| Box 10 Dependent Care Benefits | Total dependent care benefits under a dependent care assistance program (section 129) paid to the employee or incurred by the employer for the employee. |

| Box 11 Nonqualified Plans | Distributions to an employee for a non-qualified plan or a non-governmental section 457 plan. |

| Box 13 | |

| Statutory Employee | Tells whether statutory employees' earnings are subject to Social Security and Medicare taxes but are not subject to Federal income tax withholding. |

| Retirement Plan | Tells whether the employee was an active participant in a retirement plan (e.g., pension, profit-sharing, stock-bonus plan, annuity plan, simplified employee pension, trust). |

| Third-Party Sick Pay | Tells whether the employer is a third-party sick pay payer filing a Form W-2 for an insured's employee or an employer reporting sick payments made by a third party. |

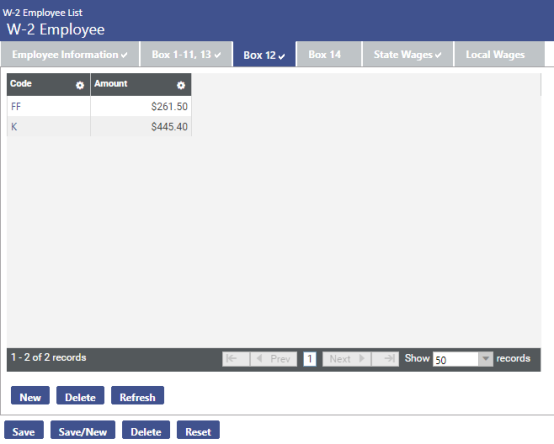

After filling in the fields on the Box 1-11, 13 tab, click the Box 12 tab. ![]() Show me.

Show me.

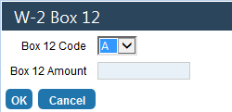

To add Box 12 information, click the New button. The W-2 Box 12 pop-up opens. ![]() Show me.

Show me.

Select the Box 12 Code to be used for this employee. The available selections are predefined.

Type the Box 12 Amount that applies for this employee.

Click OK to save your entries.

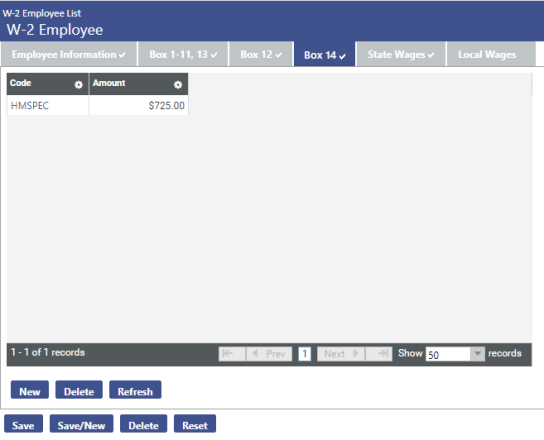

After filling in the fields on the Box 12 tab, click the Box 14 tab to bring it forward. ![]() Show me.

Show me.

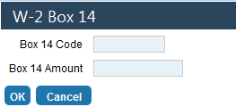

To add Box 14 information, click the New button. The W-2 Box 14 pop-up opens. ![]() Show me.

Show me.

Type the Box 14 Code to be used for this employee. The available selections are predefined. Refer to your W-2 instructions or your accountant for additional information.

Type the Box 14 Amount that applies for this employee.

Click OK to save your entries.

Note: The W-2 form displays up to four Box 14 codes and amounts.

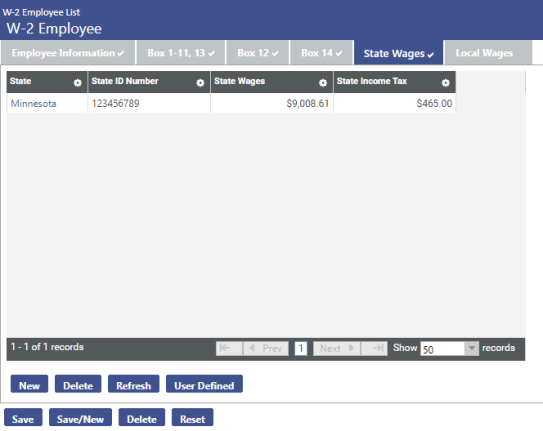

After filling in the fields on the Box 14 tab, click the State Wages tab to bring it forward. ![]() Show me.

Show me.

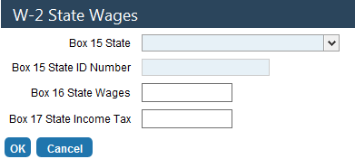

To add State Wages information, click the New button. The W-2 State Wages pop-up opens. ![]() Show me.

Show me.

| Field | Description |

|---|---|

| Box 15 State | Required. State to be used for this employee. All states are available on the drop-down. |

| Box 15 State ID Number | Required. |

| Box 16 State Wages | Required. Total dollar amount of employee's state wages. |

| Box 17 State Income Tax | Total dollar amount of employee's state income tax. |

Click OK to save your entries.

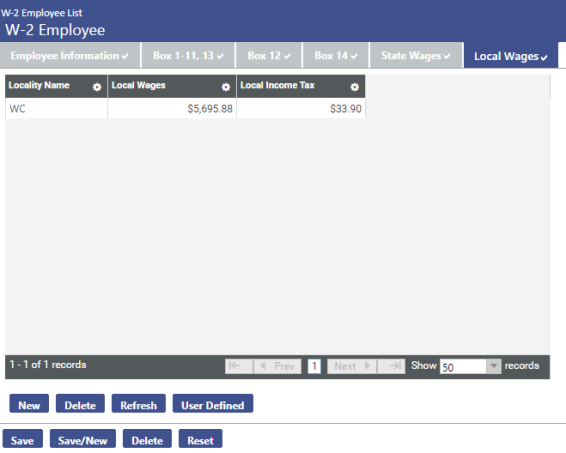

After filling in the fields on the State Wages tab, click the Local Wages tab to bring it forward. ![]() Show me.

Show me.

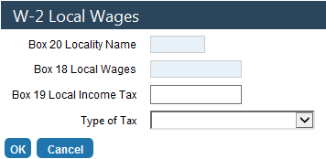

To add Local Wages information, click the New button. The W-2 Local Wages pop-up opens. ![]() Show me.

Show me.

| Field | Description |

|---|---|

| Box 20 Locality Name | Required. Name of the locality reporting local income tax information. This field may contain 5 characters. Indiana Customers: the first two letters of the locality need to contain the appropriate Indiana County Code. |

| Box 18 Local Wages | Required. Total dollar amount of employee's local wages. |

| Box 19 Local Income Tax | Total dollar amount of employee's local income tax. If this field is left blank, an entry of $0.00 displays on the list page. |

| Type of Tax | Used to designate different types of Other taxes, such as residential and city, for W-2 reporting. If an employee has been assigned an Other tax that includes a Type of Tax selection in Maintenance > Human Resources > Deductions and Benefits > Taxes > New/Edit (Tax Type = Other), the selection defaults in this field during the W-2 Create process. |

Click OK to save your entries.

After filling in all of the fields on the W-2 Employee tabs, click Save.

To print the W-2 Register, click the Print button on the W-2 Employee List page.

To see help for another page in the W-2 Processing workflow, click the appropriate link provided below:

to search for the name.

to search for the name.